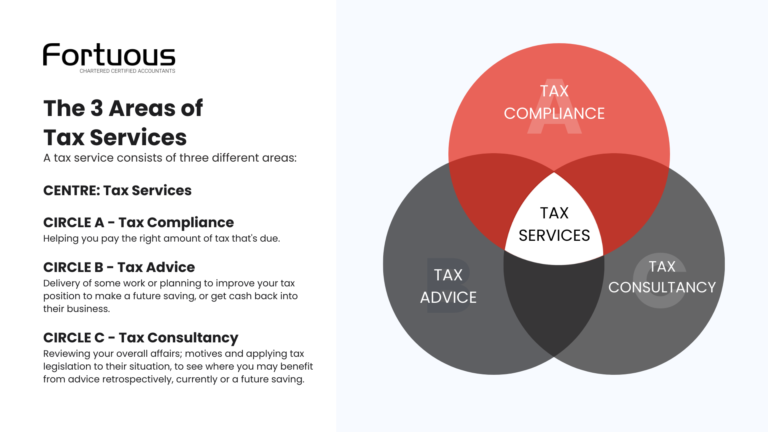

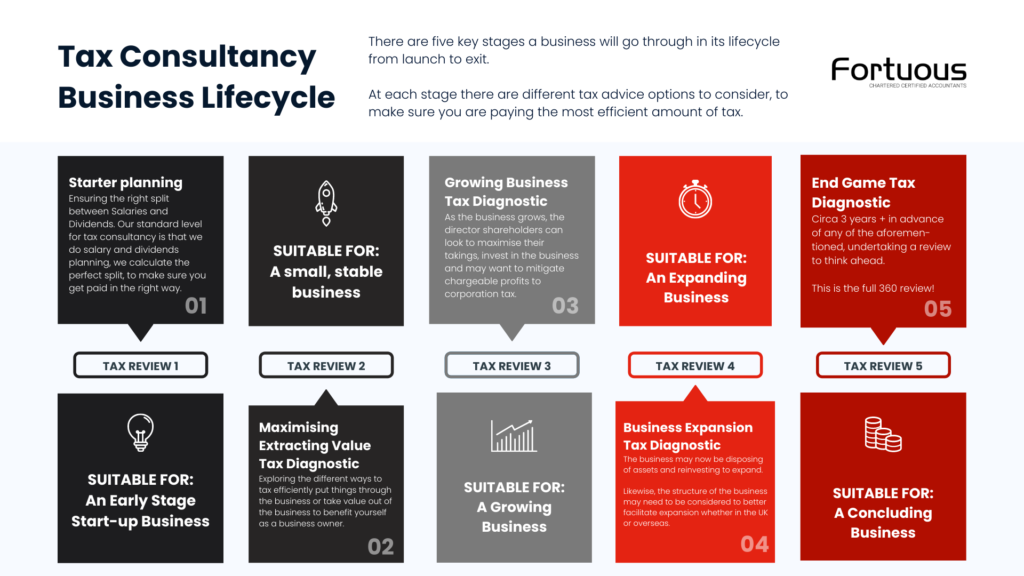

You’re not getting the tax advice you need

Saif Khalid • November 21, 2021

The post You’re not getting the tax advice you need appeared first on Fortuous.

Selling your business is a big decision. If you’re incorporated as a limited company, you’ll usually be faced with two choices for how to structure this sale. You can choose between: Both routes have their own distinct tax outcomes. Having a good understanding of these implications is extremely important before you make a decision on […]

The post Selling your business: what are the tax implications? appeared first on Fortuous.

Making Tax Digital is changing how we submit tax returns. And with Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) coming into force from April 2026, it’s time to start planning how you’ll meet the compliance requirements for MTD for ITSA. We’ve highlighted the four main areas where you need to take […]

The post What is Making Tax Digital for Income Tax Self Assessment? appeared first on Fortuous.

Keeping up-to-date records of your business transactions isn’t the most glamorous part of being an entrepreneur, that’s for sure. But, in reality, having accurate and up-to-date bookkeeping is actually one of the core ways to keep your finances (and your business) under control Digital bookkeeping is the future of your finance The digital age has […]

The post Getting your bookkeeping ready for a digital future appeared first on Fortuous.

Offering benefits-in-kind to your staff is a great way to make your business an attractive place to work. And these benefits add even more value if they’re also either tax-effective or tax-free. You can offer certain concessions that make benefits provided to your employees (including directors) either low-tax or no tax. To be clear, we’re […]

The post The top tax-effective benefits to offer employees appeared first on Fortuous.

When selling your limited company, you want to do so in the most tax-efficient way possible. Making use of the Substantial Shareholding Exemption (SSE) is one way to do this. Let’s dive in and see how the SSE limits the corporation tax you pay on any capital gains. Why should I consider the Substantial Shareholding Exemption when […]

The post How does the Substantial Shareholding Exemption help your business sale? appeared first on Fortuous.

A business mentor can provide guidance and support, so you make the right decisions and stay focused on the end goal as a business owner. They can also help you move forward in your career by providing advice and feedback on what steps to take to reach the pinnacle of success. But have you ever […]

The post Why your accountant is the mentor you didn’t know you needed appeared first on Fortuous.

Having proper control of your business finances is a big advantage. It helps you make well-informed business decisions and keeps your organisation profitable. With so many digital tools for managing your bookkeeping, accounting and management reporting, it’s never been easier to manage, track and forecast your financial position. But what are the main tools you […]

The post 5 ways to get in control of your business finances appeared first on Fortuous.

Whether you’re selling or buying, it’s important to make sure that any VAT invoices you issue or receive comply with the strict VAT regulations. Failing to do so can cause problems both for you and for your customers. If you reclaim VAT using a defective invoice, HM Revenue & Customs (HMRC) can disallow the claim. […]

The post What should be on a VAT invoice? appeared first on Fortuous.

Did you know that the UK corporation tax rates are changed from April 2023? From 1 April 2023, the rate of corporation tax changes from 19% to a variable rate between 19% to 25%, depending on the profits made by your business. This could mean a change to what you will owe in tax for the […]

The post New UK corporation tax rates from April 2023 appeared first on Fortuous.

The days of deciding on a tax planning at the start of the year and then forgetting about it are gone. As taxpayers and tax advisers, we both have to be nimble, flexible and aware of changes. That’s why regular tax-planning sessions are so important. The need for regular tax-planning conversations As your accountant and […]

The post Book a tax planning conversation with us today appeared first on Fortuous.